Financial literacy is an essential life skill that children and teenagers should be equipped with from an early age. Teaching kids about money management and financial responsibility not only helps them make informed decisions but also sets them up for a successful future. In this article, we will explore the importance of financial literacy for kids and teens and discuss effective ways to teach them money skills early.

Why is Financial Literacy Important for Kids and Teens?

Financial literacy is the ability to understand and use various financial skills, including personal financial management, budgeting, saving, investing, and debt management. By teaching kids and teens about money, we empower them to become financially responsible adults.

1. Building Money Management Skills: Teaching children about money from a young age helps them develop essential skills such as budgeting, saving, and tracking expenses. These skills will serve as a foundation for their financial well-being in the future.

2. Developing a Healthy Relationship with Money: Financial literacy teaches kids the value of money and the importance of responsible spending habits. It helps them understand the difference between needs and wants and encourages them to make thoughtful financial decisions.

3. Fostering Independence and Self-Reliance: By teaching kids about money, we equip them with the knowledge and skills necessary to manage their finances independently. This empowers them to make informed choices and take control of their financial future.

4. Preventing Future Financial Mistakes: Lack of financial literacy can lead to poor financial decisions and debt accumulation in adulthood. By teaching kids about money early on, we can help them avoid common financial pitfalls and make smart financial choices.

Effective Ways to Teach Financial Literacy to Kids and Teens

1. Start Early: Introduce basic financial concepts to children as early as possible. Teach them about coins, counting money, and the concept of saving. As they grow older, gradually introduce more advanced topics such as budgeting and investing.

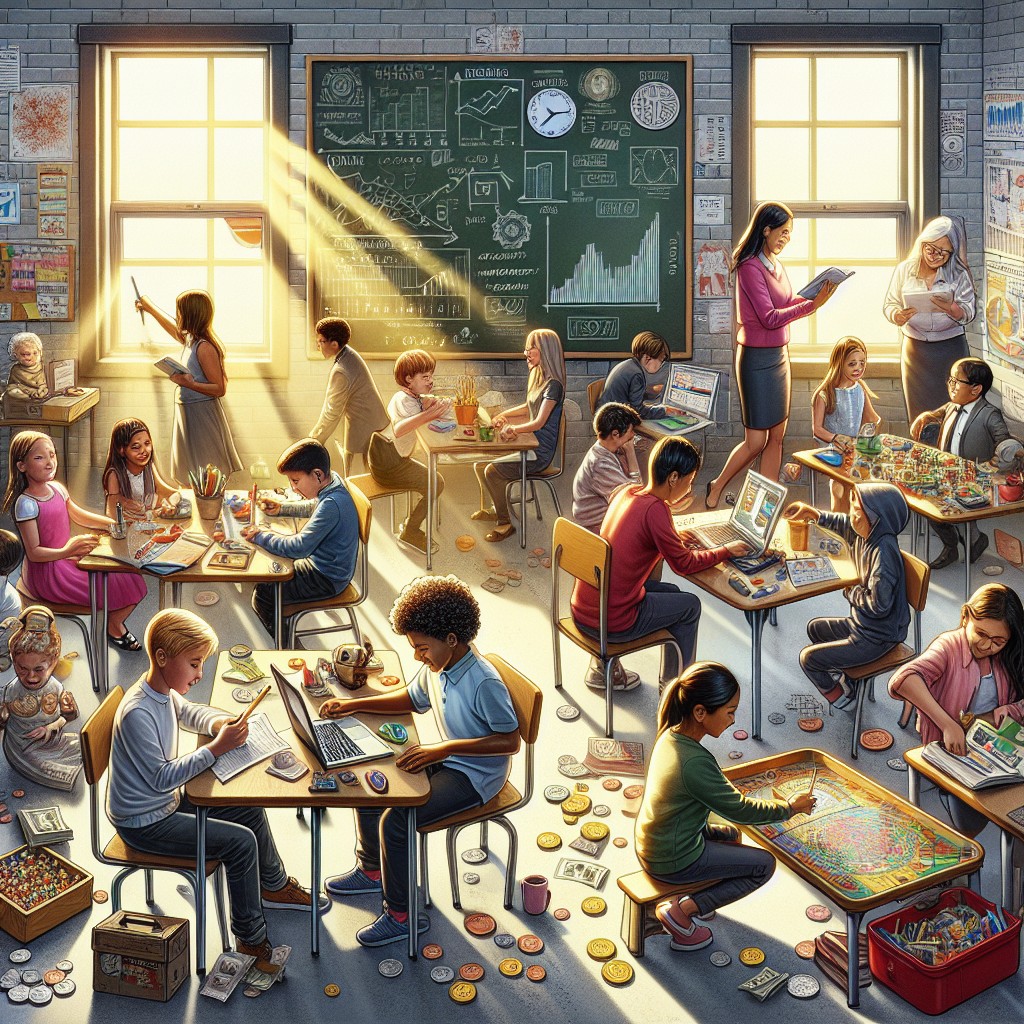

2. Make it Fun and Engaging: Use games, activities, and real-life examples to make financial literacy interactive and enjoyable. Play money-related board games, involve kids in grocery shopping, and encourage them to set savings goals.

3. Lead by Example: Children learn best by observing their parents and caregivers. Demonstrate responsible financial behaviors such as budgeting, saving, and avoiding impulsive purchases. Involve kids in family financial discussions and decision-making processes.

4. Use Technology: Leverage technology to teach financial literacy. There are numerous apps and online resources available that make learning about money fun and interactive. Encourage kids to use these tools to track their expenses, set savings goals, and learn about investing.

5. Teach the Value of Giving: In addition to saving and spending, teach kids about the importance of giving back. Encourage them to donate a portion of their money to charitable causes or participate in community service projects.

6. Provide Real-Life Experiences: Allow kids to earn money through age-appropriate chores or part-time jobs. This will help them understand the value of hard work, money earning, and financial responsibility.

Conclusion

Financial literacy is a crucial life skill that should be taught to kids and teens. By equipping them with money management skills and knowledge, we empower them to make informed financial decisions and secure a prosperous future. Start teaching financial literacy early, make it engaging, and lead by example. By doing so, we are setting our children up for financial success and independence.

Share This Article

More Articles You Might Like

Discover More Content

Explore our collection of articles across various topics and categories. From cutting-edge technology insights to wellness wisdom, we curate the best stories to expand your horizons.

Article ID: 280