In today's uncertain world, having an emergency fund is more important than ever. Whether it's an unexpected medical expense, a job loss, or a major home repair, having money set aside for emergencies can provide peace of mind and help you navigate through tough times. This article will discuss smart ways to build an emergency fund and why it matters.

1. Set a Realistic Savings Goal: Start by determining how much you need to save for emergencies. Financial experts recommend saving at least three to six months' worth of living expenses. However, this amount can vary depending on your individual circumstances. Consider factors such as your income stability, family size, and any specific risks you may face.

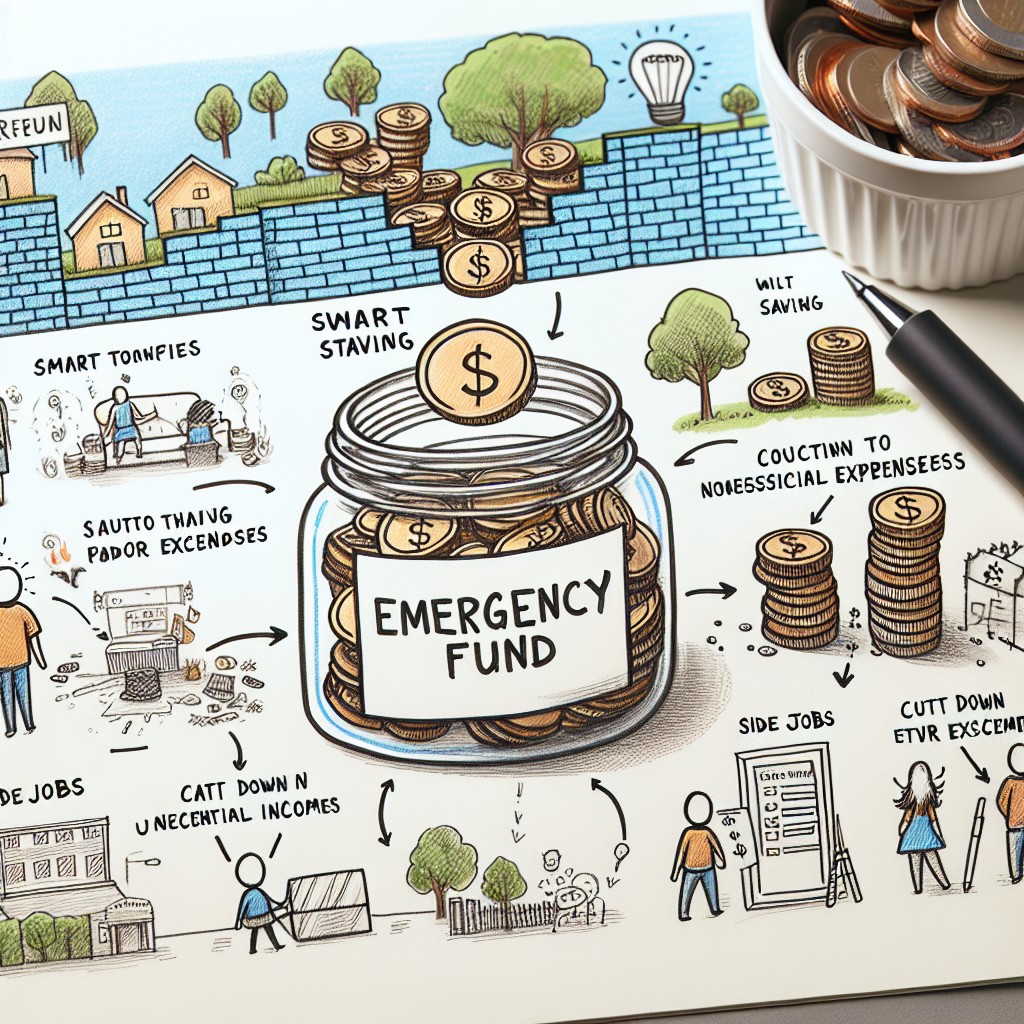

2. Create a Budget: Building an emergency fund requires discipline and commitment. Start by creating a budget to track your income and expenses. Identify areas where you can cut back on discretionary spending and allocate those savings towards your emergency fund. By tracking your spending, you can identify any unnecessary expenses and redirect that money towards your savings goal.

3. Automate your Savings: Make saving for emergencies a priority by automating your savings. Set up an automatic transfer from your checking account to a separate savings account dedicated to your emergency fund. By automating the process, you won't have to rely on willpower alone to save consistently.

4. Reduce Debt: Paying down high-interest debt should be a part of your emergency fund strategy. By reducing your debt burden, you'll have more disposable income to allocate towards savings. Prioritize paying off credit cards, personal loans, or any other debts with high-interest rates.

5. Explore Additional Income Sources: Consider taking on a side gig or freelancing to boost your income. Use the extra money earned to accelerate your emergency fund savings. This additional income can help you reach your savings goal faster and provide a safety net during financial emergencies.

6. Cut Expenses: Look for opportunities to cut expenses without sacrificing your quality of life. This could include negotiating bills, shopping smarter, or downsizing certain expenses like dining out or entertainment. The money saved from these cutbacks can be redirected towards your emergency fund.

7. Keep the Fund Separate: Once you start building your emergency fund, it's crucial to keep it separate from your regular checking or savings account. Having a designated account for emergencies ensures that the money is not easily accessible for everyday spending. Consider opening a high-yield savings account or a money market account that offers higher interest rates.

8. Reassess and Replenish: Regularly reassess your emergency fund to ensure it aligns with your current needs and financial situation. As your income and expenses change, adjust your savings goal accordingly. Additionally, if you have to dip into your emergency fund, make sure to replenish it as soon as possible.

In conclusion, building an emergency fund is a vital component of a healthy financial plan. By following these smart strategies, you can establish a safety net that provides financial security and peace of mind during unexpected events. Start small and be consistent, and over time, you'll have a robust emergency fund to rely on in times of need.

Published on June 12, 2023

Smart Ways to Build an Emergency Fund and Why It Matters

Share This Article

More Articles You Might Like

Discover More Content

Explore our collection of articles across various topics and categories. From cutting-edge technology insights to wellness wisdom, we curate the best stories to expand your horizons.

Article ID: 291